Tax compliance software for your industry and tax type

Tax rules, rates, and boundaries make up a layered, three-dimensional web that constantly finds new ways to trip businesses up. Avalara works with businesses of all sizes to help simplify tax compliance by providing accurate calculations in real time. Their comprehensive suite of solutions includes prebuilt integrations that connect to the systems you trust, as well as a robust API for businesses that prefer building their own systems. Regardless of the industry you’re in or the tax types you encounter, Avalara can help you save time, free up resources, and reduce risk — so you can focus on what matters most to your business.

RETURNS

Offload the returns process, from preparation and filing to remittance. Track various filing calendars and manage requirements for each jurisdiction.

CALCULATIONS

Get sales and use tax calculations based on the latest rules and rates delivered to supply line or invoicing applications in real time.

DOCUMENTS

Automatically omit tax from exempt sales and efficiently manage exemption documentation from the cloud.

AVALARA CAN HELP YOUR SOFTWARE CUSTOMERS SOLVE COMMON COMPLIANCE CHALLENGES:

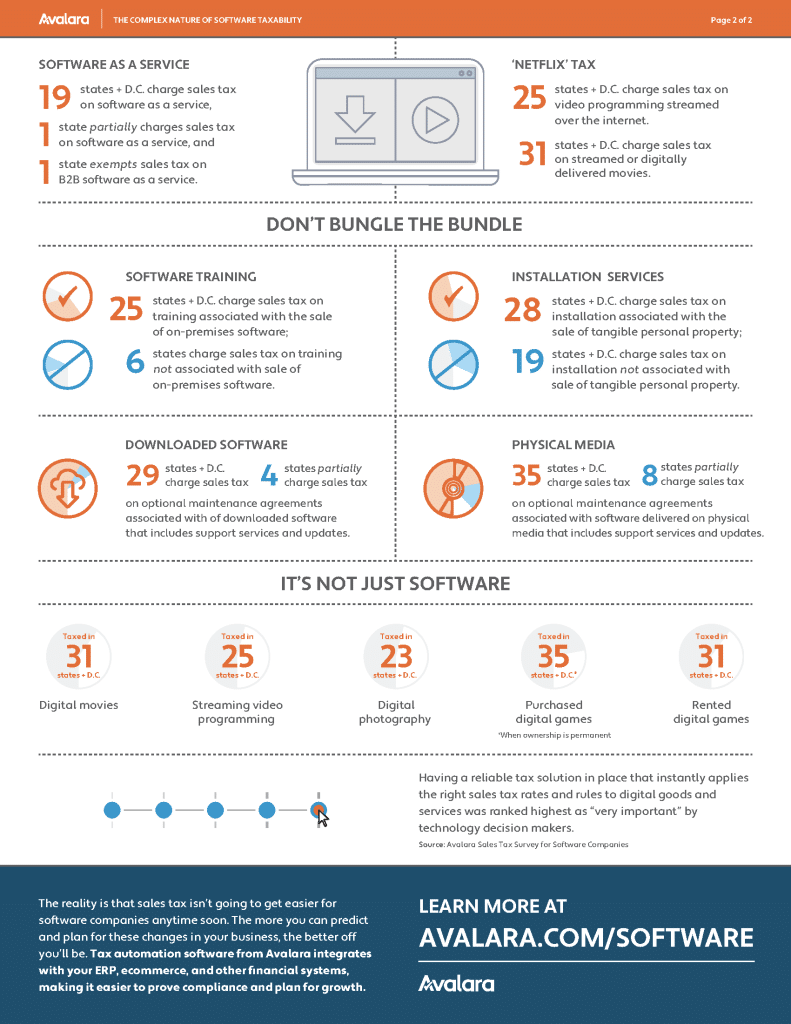

Remote selling thresholds, remote employees, physical locations, and affiliate relationships can create myriad tax obligations. Automation can help your customers stay compliant by tracking tax and rule changes across jurisdictions.

Software companies inevitably accrue more nexus obligations when they sell across jurisdictions or internationally. Avalara can help your customers monitor nexus thresholds in each state, so they don’t have to spend time looking up complex tax rules. They’ll also get help tracking filing requirements so they can file on time everywhere they need to.

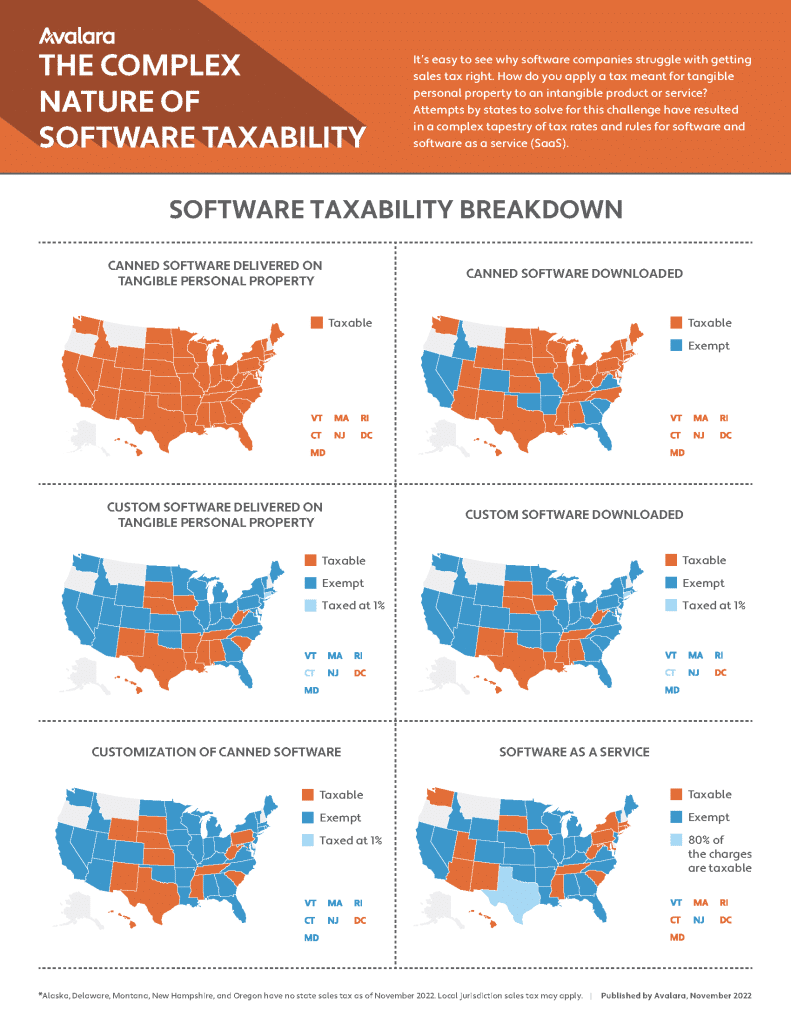

Understanding and managing all the distinct tax calculations required for software sales is challenging as it is. Add thousands of tax jurisdictions (each with a different set of rules) to the equation and it can get messy in a hurry. The Avalara tax engine accounts for different product taxability rules in each jurisdiction and applies rates based on the details of each individual sale.

Tax documentation is a hassle, even more so when incorporating all the distinctions of software tax. Help your customers avoid costly fines from audits when they have all their necessary documentation at the ready.

If your customers are selling in new markets or expanding their product line, they’re likely accruing additional tax obligations. By automating time-consuming tax compliance tasks, they’ll be able to focus on what matters most to their business.